Message from the Secretary

Transportation is critical to Pennsylvania's economic vitality and well-being. We see that theme across history, and it holds true today in a time of transformative change. Now, enabled by technology and driven by data, the Commonwealth's transportation system can become more efficient, responsive, sustainable, resilient, and equitable than ever before

Pennsylvania's 2045 Long-Range Transportation Plan (LRTP) outlines a future transportation system that

Pennsylvanians are creating together.

Transportation agencies provide facilities and services essential to everyday life. As such, we must be

able to react effectively to abrupt changes and urgent situations, such as those thrust upon us by the

COVID-19 pandemic and the relentless impacts of climate change. The Pennsylvania Department of

Transportation (PennDOT) makes investments in roadways, bridges, public transit, and other

infrastructure that last decades, and must do so with a strategic future perspective that considers

big-picture outcomes for the Commonwealth's transportation system and its users.

The plan's goals are inspiring and were developed based on broad engagement with diverse stakeholders,

the public, and underrepresented interests, which is the cornerstone of the planning process. This

resulted in wide-ranging and valuable feedback, so much so that a major goal and objectives specific to

addressing equity are a key part of the LRTP.

Our ability to achieve these goals—even with the extensive collaboration with our partners and

stakeholders—depends upon securing adequate resources. Implementing strong investment proposals like

that put forward by the Transportation Revenue Options Commission will be essential for advancing much

of this plan.

Under any funding scenario, collaborating with other agencies, other levels of government, the private

sector, MPOs/RPOs, and the public is vital to making positive, systemwide improvements. I am pleased

with the diverse engagement that has occurred with such partners, with the aim of collaborative

implementation to accomplish common purposes.

Transportation is about fostering opportunity. We must make wise investments in our infrastructure and

services that yield great returns, opening opportunities for all Pennsylvanians. As stewards of the

statewide transportation system, that mindset is at the heart of this plan and our commitment to

implementing its strategic actions and initiatives. We are embracing new tools, skills, processes, and

perspectives to accomplish this plan.

A special thank you to the many individuals who provided input during the development of the

Commonwealth's 2045 Long Range Transportation Plan. We ask that all Pennsylvanians remain involved as we

implement the plan's action strategies and initiatives that will strengthen our transportation system,

programs, and services long into the future.

Pennsylvania Department of Transportation

The Essentials

The statewide long-range transportation plan (LRTP) establishes a direction for Pennsylvania's transportation system across a 20-year planning horizon.

This 2045 PA LRTP has been developed alongside a PA Freight Movement Plan (FMP), available on PennDOT's Planning Program's Project Webpage. The two plans complement each other, establishing a comprehensive direction for enhancing the movement of people and goods within and through the state.

The statewide LRTP does not include specific projects, such as bridge replacements or major road improvements. These projects are developed regionally by the state's metropolitan and rural planning organizations (MPOs/RPOs), known as PennDOT's Planning Partners. Each MPO/RPO develops a regional LRTP in step with the statewide direction.

PennDOT produces modal and functional plans that relate to the LRTP, including:

Transportation Planning Process

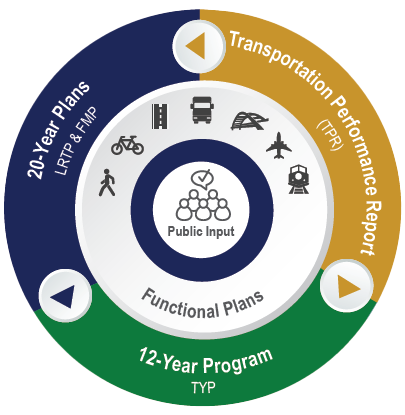

Long-range planning is one of three key phases of transportation improvement. Plans guide development of

Transportation Improvement Programs (TIP) established at the regional level. The TIP projects are rolled up

into a Statewide Transportation Improvement Program (or STIP) and included in the statewide 12-Year Program

(TYP), which is updated every two years.

In the off-year, the State Transportation Commission (STC) and Transportation Advisory Committee (TAC)

compile a Transportation Performance Report (TPR), which serves as a report card on the transportation

system and helps direct future programming to achieve plan goals. It is a cornerstone of the TYP development

process.

The update of both the LRTP and 12-Year Program included extensive outreach to the public and transportation

stakeholders to ensure that public perspectives are considered as part of the process.

More information about the transportation planning process is available on Talk PA

Transportation.

Sets Direction

- Long-Range Transportation Plan (LRTP) 20-Year Plan

(Updated every 6-10 years)- Where do we want to go?

- Goals

- Objectives

- Measures

- How are we going to get there?

- Implementation Strategies

- Policies

- Priorities

- Functional Plans

- MPO/RPO LRTPs

- Where do we want to go?

Prioritizes Projects

- 12-Year Program (TYP)

- How can we best use available funding?

- Lists funded projects for a 12-year period

- First four-year period is the Statewide Transportation Improvement Program (STIP)

- STIP complies MPO/RPO Transportation Improvement Programs (TIP)

- How can we best use available funding?

Measures Progress

- Transportation Performance Report (TPR)

(Updated in odd-numbered years)- How did we do?

- Monitor

- Report

- Evaluate

- Where do measures come from?

- State and Federal Requirements

- What do we measure?

- Safety

- Mobility

- Accountability

- Funding

- Preservation

- How did we do?

Public & Stakeholder Involvement

Many voices throughout the Commonwealth provided the foundation for effective development and successful implementation of Pennsylvania's 2045 LRTP. The scope and scale of outreach conducted for the LRTP was greater than for any previous plan. The users of the statewide transportation network provide an essential perspective in helping to shape the plan's strategic directions.

To capture transportation system needs and concerns across Pennsylvania, input was solicited in various forums and incorporated at key points during plan development. In addition to statewide public outreach and stakeholder engagement, extensive “in-reach” was a key element of the stakeholder engagement process. PennDOT units and partnering agencies and organizations were engaged to ensure that current and future initiatives would be properly reflected and supported by the LRTP's implementation plan.

The success and implementation of the LRTP strongly depends on public and stakeholder involvement and participation. Feedback was requested on the draft plans through the Public Comment Period from September 20 – October 19, 2021.

Significant effort was made to maximize public outreach during the comment period, through social media, email campaigns and targeting underserved populations such as senior citizens, people with disabilities, and marginalized communities.

This combined outreach process was used for both the 12-Year Program and the LRTP.

Public Outreach

Public Outreach

7,400

Public Surveys Completed

1,905

Public Forum Views

2,700

E-News Contacts

11

Social Media Posts

Stakeholder Engagement

Stakeholder Engagement

24

MPOs and RPOs Engaged

8

STC & TAC Presentation

5

Freight Focus Group

Meetings by Mode

225

Freight Forum Registrations

25

Equity & Diversity Workshop Attendance

9

PennDOT Planning Network e-Blasts

49

State Planning Board Attendance

PennDOT In-reach & Interagency Collaboration

PennDOT In-reach & Interagency Collaboration

35

Executive Interviews

40

PennDOT Bureau/District Personnel Engaged

5

Partnering Agency Interviews & Presentations

Public Comment Period Engagement

Public Comment Period Engagement

183,392

Social Media Reach

2,230

Public Website Page Views

8,083

Email Campaign Contacts

17

Federally Recognized Tribes Contacted for Feedback

618

Public Libraries with Printed Copies

*Social Media Definitions

-

1. Reach is the number of people who saw any content from the PennDOT page or about the PennDOT

page.

2. Impressions are the number of times any content from PennDOT or about PennDOT entered a person's screen.

3. Engagement is any action someone takes on PennDOT’s page or one of PennDOT’s posts.

What We Heard

Key Themes from the Public Survey

Public feedback was obtained through an online public survey and public forum hosted by PennDOT and the STC for the 2023 12-Year Program update. Extensive outreach and promotions were launched through the STC website, including email blasts to thousands of stakeholders, a targeted social media campaign offered in Spanish and Mandarin—the two most-spoken languages in Pennsylvania after English-traditional media outreach, and outreach in partnership with stakeholders.

1. Road Pavement

Repairing, restoring, reconstructing, and maintaining state and local roads

2. Bridges

Repairing, replacing, and maintaining state and local bridges

3. Traffic Flow

Using technology to improve traffic flow, add new lanes, and construct new roads

4. Interstate Highways

Specific, prioritized investments in Interstate reconstruction

5. Walking

Accessible and connected walking routes

6. Transit

Accessible and frequent public transportation options that cover an extensive area and cross regions

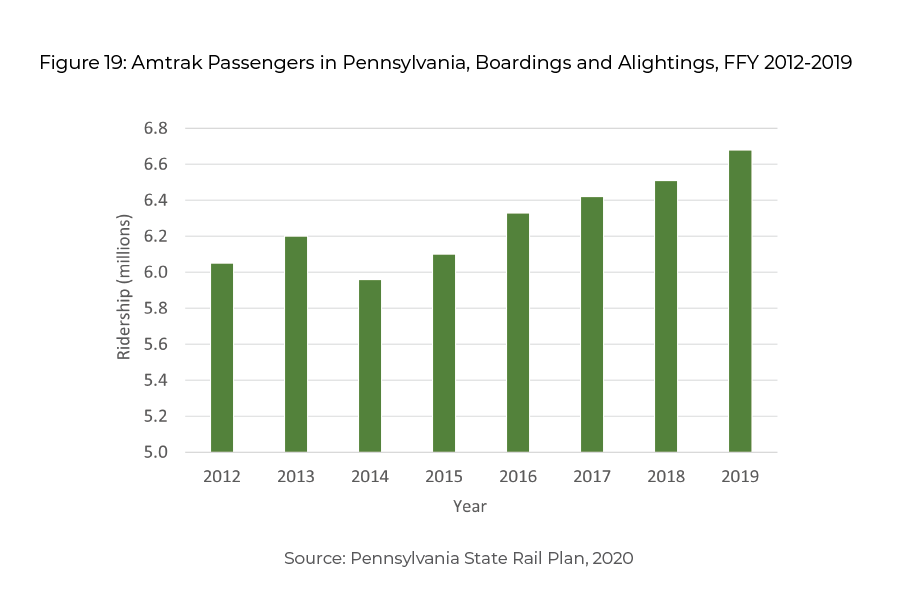

7. Passenger Rail

Intercity and commuter rail service with out-of-state connections

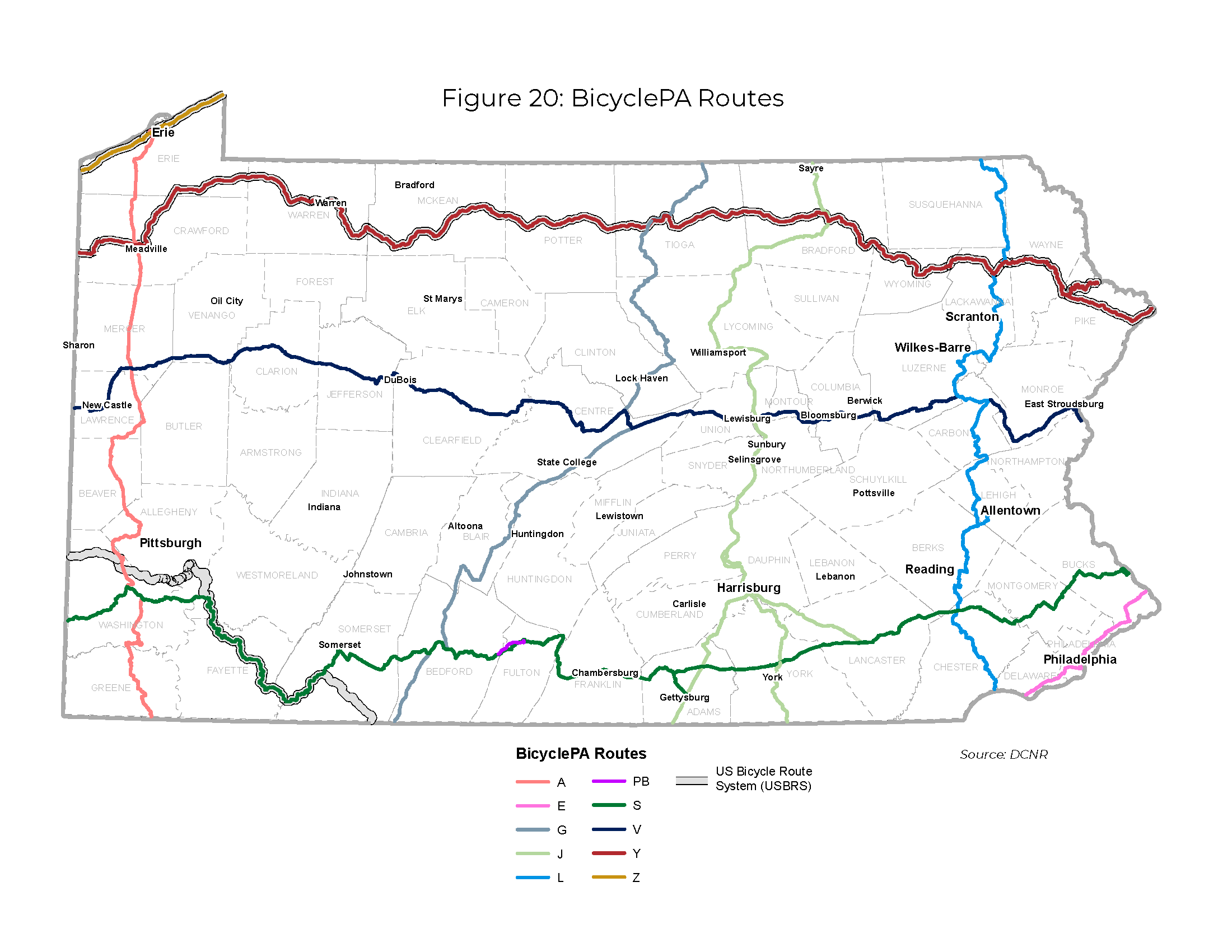

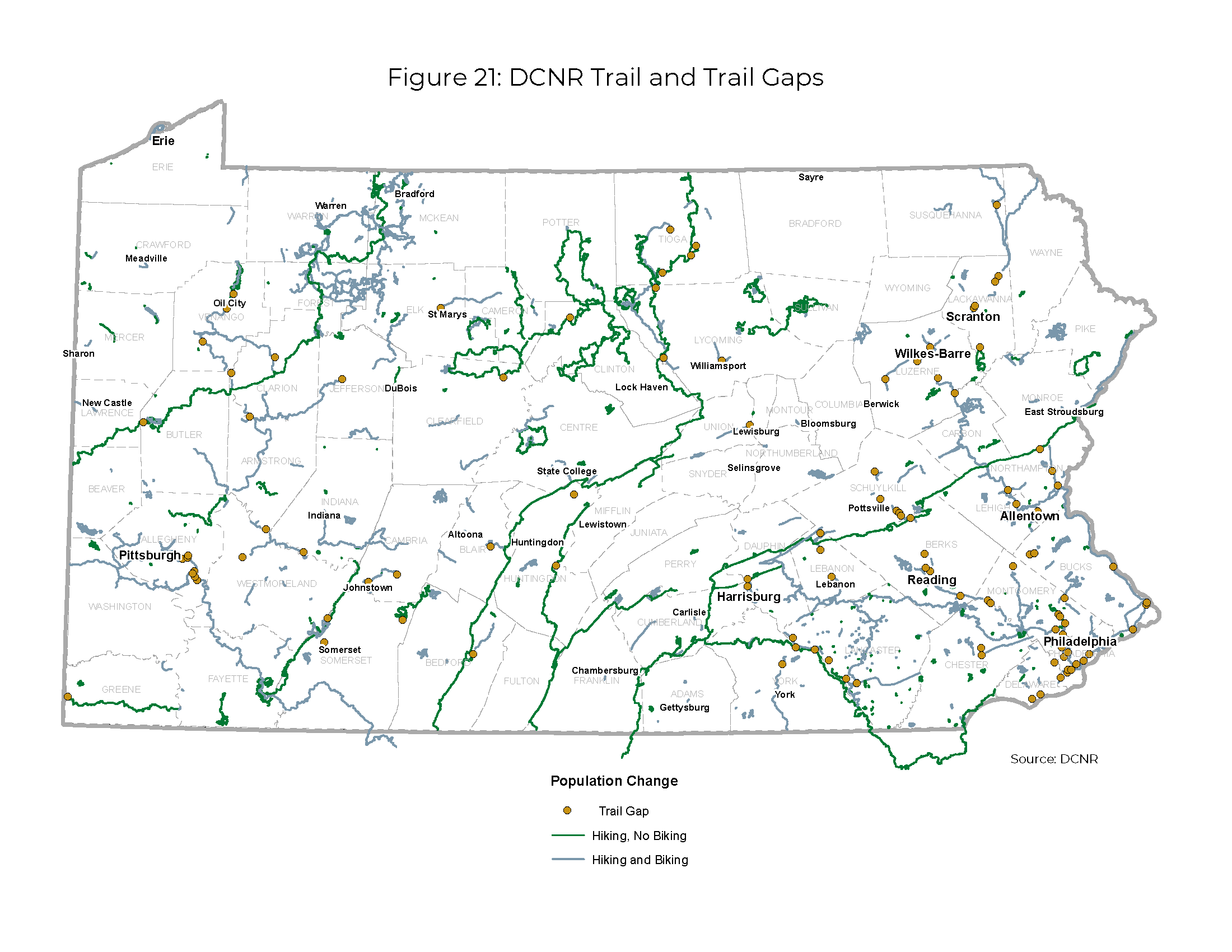

8. Bicycling

Safe routes and facilities throughout the state

9. Freight

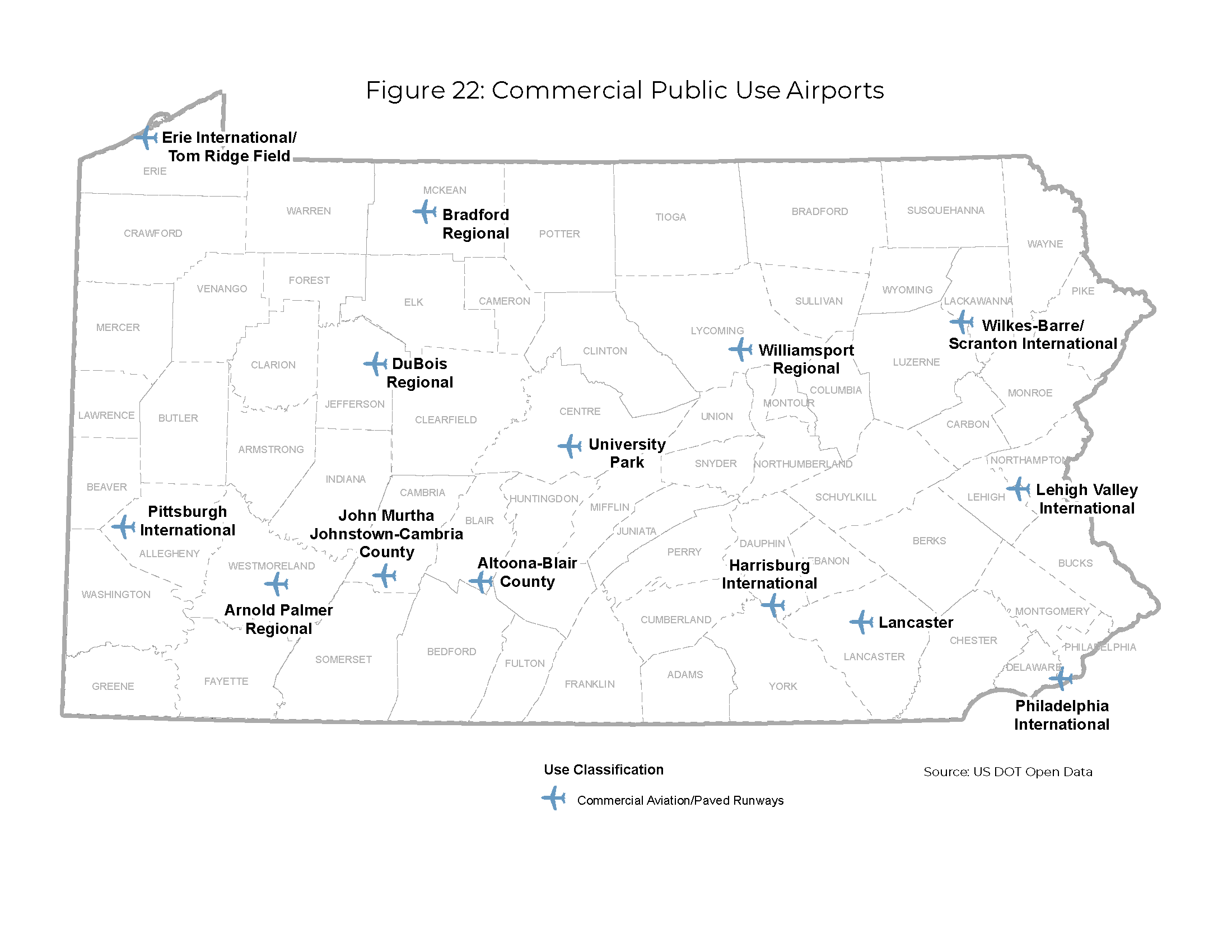

Modern highways, railways, airports, and ports to support the economy

10. Aviation

Modern facilities, operations, and a wide range of commercial airline choices

Key Themes from the Freight Industry

Freight networks are critically important to the supply chain which moves essential raw materials as well as finished goods.

Issues such as truck parking will become more challenging as our reliance on goods movement continues to grow.

Trending issues such as automated vehicles, the explosive growth of e-commerce, and changing supply-chain patterns are poised to affect our planning.

It is imperative to reduce the impact of transportation on our changing climate.

We must abide by the value of fairness in working to meet the transportation needs of all our communities and citizens.

.png)

.png)

.png)